The goal of business process transformation is to make the system more efficient, customer-friendly, and profitable. All of these can happen because, as processes are digitized, they become simpler, faster, and more user-friendly, leaving minimal or no scope for human intervention and errors. “Success in today’s financial markets requires unprecedented levels of speed, accuracy, and cost-efficiency beyond what a human force can provide” (Bill Cline, KPMG Advisory Principal).

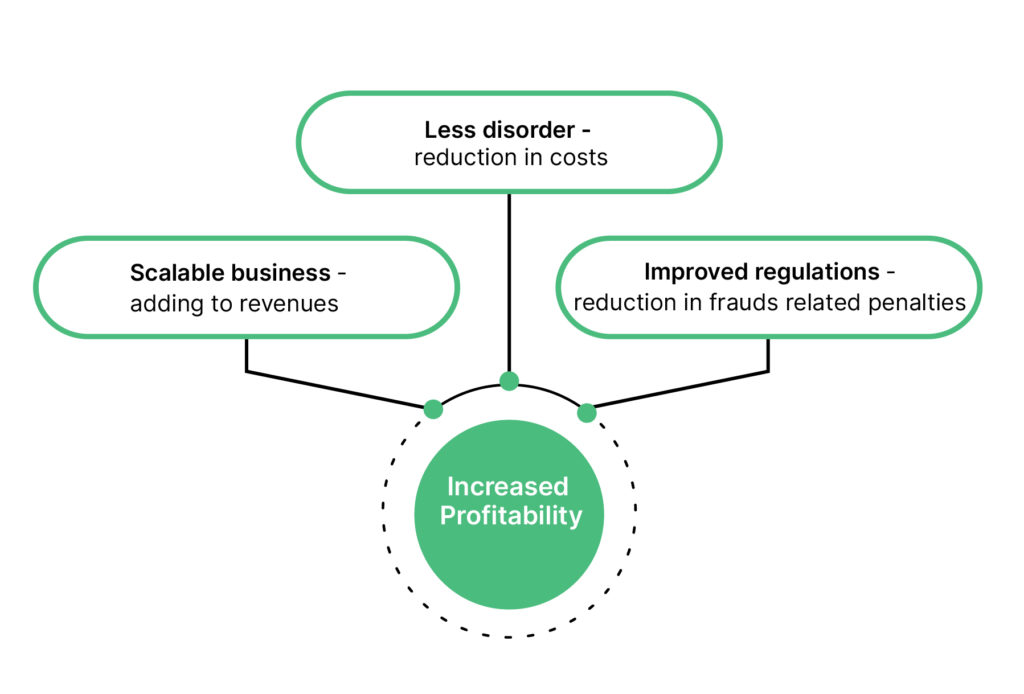

Robotic Process Automation (RPA) helps exactly achieve this objective. With the increase in process quality and faster processing, services become affordable and more reliable. As per the KPMG report, RPA can save financial services firms 40-75% in cost, depending on the level of adaptation) which directly adds to the profitability of these firms. RPAs can be used across front office, middle office, and back-office functions aiding in a highly scalable business model with lesser disorder and improved regulations. The following are the advantages:

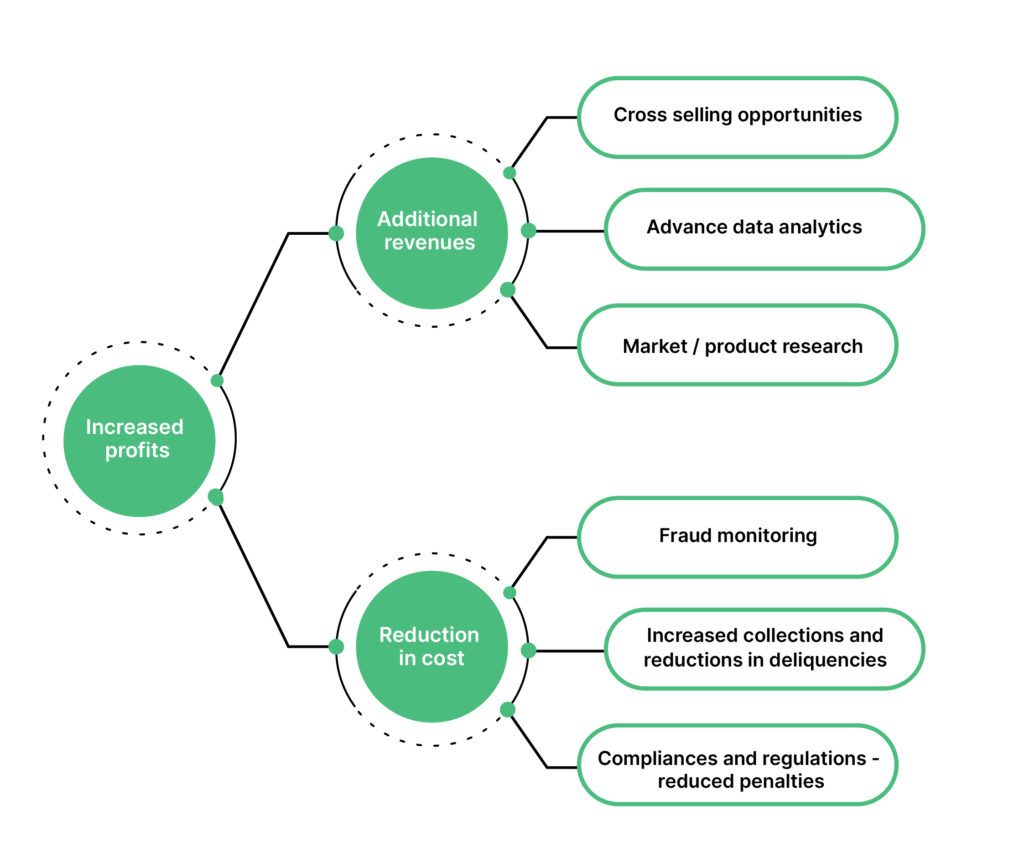

In addition to these benefits, RPA systems also integrate the overall systems, processes, and infrastructure. This integration results in reducing the overall infrastructure costs that further add to the profitability. These systems can gather and analyze a vast amount of data to provide complete information about the results. This material can then be used for various purposes, such as cross-selling, fraud monitoring, KYCs, enhancing compliances, improving collection efficiencies, market research, and advanced data analytics. Each of these doles help in profit enhancement in the following ways:

Adoption of RPA by Indonesian Banks and Finance sector

A survey on the finance sector conducted by PWC on the adoption of RPA suggests that the respondents are still at the stage of adaptation. While 94% of the respondents agreed that they are willing to increase or continue with the same level of investment in automation, the pandemic is the primary cause of acceleration. In fact, across industries within Indonesia, finance and banking functions will be the dominant departments that will first adopt RPA for reasons that are related to sustainable earnings and higher profits.

Conclusion

Technological Innovation and Artificial intelligence are bound to sweep the world, especially the finance industry, in the next decade. The RPA process can be used across banking functions like retail, commercial, corporate, anti-money laundering, compliances, back offices, customer service, etc. RPA is the fastest-growing segment of enterprise software with 63% growth in 2018, as per Gartner. There is a growing demand from all the stakeholders for increased profitability and optimized cost of the banking industry, so they stay ahead of the competition. Indonesian banks, in particular, need to pace up their RPA processes to survive globally. On top of it, the kind of benefits and profit augmentation that RPA leads to justifying no reason why Indonesian banks should shy away from shifting towards the same.